This is a stock pitch I led as Portfolio Manager for the Media & Telecom sector of the Tartan Student Fund, Carnegie Mellon's student-run long-only investment fund, on 11th November 2023. The pitch was close to passing but just fell short of the majority vote at 45%.

My recent thoughts 4 months later reflecting on the pitch:

The business has recurring revenue with software-like gross margins and runway to higher-price/margin 5G rollout. I think there is great upside potential with Gogo but there were some crucial points missing in my understanding of the business at the time. Namely, I didn’t have a full understanding of how much R&D dollars need to be spent over the next couple years and thereafter. My model drives R&D as a % of revenue and therefore puts less present value weight on the cost that is larger in magnitude in the future. In retrospect, the magnitude should probably be in reverse with the next couple years being high and then decreasing after. Redoing it, I would model fixed costs using a growth rate. Looking back at historical data, I am also unsure as to why Gogo’s valuation did not rerate after the commercial aviation divestiture. That business was lower margin and probably had less of a moat on the demand side but the valuation has been declined since. I think we can own this after some more understanding.

Thesis: Gogo is the sole market leader poised for continued growth beyond 2024 after its next-gen technology rollout.

1. Gogo is the market leader in US business aviation connectivity with a long penetration runway

2. Near-future product offerings further improve pricing power

3. Cost reductions and capital allocation optionality upon completion of 5G upgrade

4. Current skepticism around the risk of further 5G delays present a buying opportunity

Background Setup

Despite strong fundamentals, Gogo is being discounted by the market due to short-term manufacturing issues.

After spinning off its commercial aviation wireless business in 2020, Gogo now exclusively focuses on domestic inflight connectivity solutions for business aviation.

Now, Gogo operates in a largely untapped market, with approximately 78% of the world's business aircraft lacking broadband connectivity.

Gogo is almost complete with a once-in-a-decade network upgrade to offer 5G products, which are 5x faster than current 4G products and command premium ARPUs.

As Gogo’s profitability has grown since the spin-off, its stock has gradually climbed over the past 3 years despite competition by satellite connectivity competitors and the emerging Starlink by SpaceX. However, its stock price is now down 40% from July 28, when they announced that the next generation of their main ATG product would be delayed in launching by 2Q from end-2023 to mid-2024.

Gogo has an unrivalled competitive advantage in an industry with a clear growth runway, and a clear plan for increasing top-line growth beyond 2024. This drop appears to be a large overreaction from the market.

Company Overview - Background

Gogo is the leading provider of in-flight connectivity solutions to business aviation (BA) planes in the U.S.

It is #1 in the U.S. for selling in-flight Internet services to business aviation

HQ: Broomfield, Colorado

Market Cap: $1.36B

TAM: $4.85B

FY22 Revenue: $404.1M

FY22 Operating Margins: 35.2%

P/E: 10.0x

EV/EBITDA: 14.8x

Revenue 3Y CAGR: 12.37%

Revenue 10Y CAGR: 4.34%

Very crucially, Gogo sold its crappy commercial aviation (CA) segment to Intelsat in Dec 2020

CA was unprofitable because of intractable satellite capacity costs & expensive antenna installation subsidies to airlines - negative cash flow was exacerbated during onset of COVID.

This divestiture allowed Gogo to focus on its BA segment which is uniquely well-positioned in an attractive and underpenetrated market.

Post-sale, Gogo’s profitability and growth have taken off in the past 3 years, going from -$250M in FY20 to $150M in FY21.

Management & Guidance

Management

CEO: Oakleigh Thorne

On Gogo’s board since 2003, owns 30% of Gogo

Former CEO of eCollege.com, 5x-ed its equity value from 2000-2007.

Former CEO of Commerce Clearing House, led its $1.9B sale in 1996.

CFO: Jessi Betjemann

Previously Gogo’s SVP of Finance, Chief Accounting Officer and Treasurer, VP of FP&A

Led sale of CA division to Intelsat in Dec. 2020

Guidance Targets

Long-term free cash flow guidance of $125 million (2023) and $200 million (2025)

Utilize AVANCE to expand TAM through global LEO satellite solution partnership

Company Overview - Business Model

Gogo generates equipment revenue by selling to BA plane owners, earning recurring service revenue after. It is very similar to the Razor-Razorblade Model.

Gogo has many offerings of products, so to sum them all up:

Cost of physical equipment varies widely by system

$50,000 (Avance L3) to $220,000 (Avance L5 with 5G) plus $50,000 installation fee

Avg. monthly subscription ARPU ~$3,300, varies by subscription plan & system

Classic < Avance L3 < Avance L5 < Avance LX5 < LEO

These are extremely sticky products locking customer in for the life of the plane, with near zero rates of customers switching to competitors once Gogo’s systems are installed.

It should also be noted that these segments are very high margin for Gogo, with service revenue and equipment revenue having 80% and 30% gross margin respectively.

Product Offerings Explained

There’s a lot of terminology, so I will do my best to explain them in terms of what Gogo is actually selling.

Air-to-Ground (ATG) = Domestic Use

Gogo’s primary platform, AVANCE, provides ATG in-flight service.

Initial investment to install equipment, monthly service fee for utilization

Software-centric, common components operate in single system across devices

Provides Internet, inflight entertainment, movement maps, voice service, 3rd-party router, satcom systems, talk and text, cloud-based support, network management

Notably, there has been a gradual shift of consumers toward pricier & better AVANCE from

Gogo is discontinuing their old and slow Classic ATG systems, with existing networks require upgrade to AVANCE by 2026. In tandem, Gogo is developing its 5G networks to deliver faster speeds with 150 cell sites.

AVANCE LX5 (5G) platforms upgrade easily from AVANCE L5 (4G) and AVANCE L3 (3G), with only some components needing to be swapped. They also have interchangeable form factors to easily integrate with existing cabin management systems.

Gogo Galileo (LEO) will also run on AVANCE in the future

Satellite = Global Use

Gogo’s 2KU provides narrowband satellite services for global use

Combines Intelsat EpicNG GEO satellites with OneWeb’s LEO constellation

Average equipment revenue of $206,000 and monthly service fee of $4.475M (2022)

Engineering expenses increased to $29.6M (2022) due to global broadband development program costs

Gogo expects to launch Global Broadband Program (Galileo) in early 2024 involving LEO (low earth orbit) satellite technology - offering the best of both worlds: fast speeds and wide global connectivity

This will combine capacity from ATG and LEO satellite network to improve upon stand-alone LEO

Partnership with OneWeb to utilize global LEO

This will, if successful, likely expand TAM by ~14,000 airplanes worldwide who can’t be serviced by ATG due to flight paths

Global Broadband Program currently unavailable despite plans for completion by 2023 and launch in 2024

Hardware integration risks associated with singular operator

Gogo does not offer traditional Geostationary Orbit solutions that some competitors like Viasat offer. In short, GEO is global, but slow.

Here is a table summarizing the technologies and how their use cases differ:

Each solution carries trade-offs:

ATG is relatively quick and affordable, but limited to land use (domestic)

GEO is similarly priced to ATG and covers international use, but is slow

LEO is quick and covers international use, but expensive.

Gogo has the best price/performance product in ATG & is expanding to LEO.

Competitors

Gogo has a few competitors in the industry:

SmartSky Networks (ATG)

This is the closest competitor to Gogo. It has a competing ATG system in initial stages of rolling out after facing constant delays (LITE ATG)

However, it has much slower speeds than Gogo’s proposed 5G solution

It is attempting to incentivize customers with discounts & benefits, e.g. $25,000 cash-back following activation with trade-in of previously installed Gogo system

The company has a suspiciously unproven track record, with no OEM relationships and no brand name - both unlike Gogo’s incumbent position.

Viasat (GEO Satellites)

Viasat sells solutions primarily to commercial aviation (United, Delta, American, JetBlue), with less focus on the BA segment Gogo dominates.

Furthermore, while its IFC connectivity solutions are global, they come with higher latency and are less functional in the U.S.

Starlink (LEO Satellites)

Shiny global satellite coverage with world’s largest constellation.

Because it is new, it is significantly more expensive than Gogo’s solutions

Starlink for Aviation program features min. $150,000 equipment cost and $25,000 per month after as subscription cost.

Industry Overview - Business Aviation

Business aviation is seeing demand surges and OEM backlogs, fuelling a need for Gogo’s connectivity solutions.

Gogo covers almost the entire market and has strong manufacturer relationships, being line-fit on 27 of the 28 different BA jets produced by 9 different BA OEMs. Existing BA jets are largely untapped, while new jets adopt Gogo’s products at favorable rates. Currently, only 35% of TAM has a connectivity solution. The US (Gogo’s main market) receives the majority of BA jets. OEMs historically built 600-800 planes a year for BA buyers worldwide and ~50% are delivered to within the US and almost all adopt Gogo’s products.

Customers often adopt Gogo’s solution for domestic travel + competitor satellite solutions for international travel. They are highly complementary to competitors due to both’s functional limitations.

Post-COVID, business aviation has seen several crucial tailwinds:

Growth in Younger, High Net Worth Individuals

67% of GOGO’s customers are now Gen X, Y, Z who predominantly drove the sustained shift to private travel during COVID.

Worldwide business jet sales surged by over 30% since early 2020, showcasing a strong recovery and growing demand in the sector post-Covid

OEM sales of new jets and fleet sales of fractional ownership are up 44% from 2020 largely driven by new private flyers

Significant Increase in Data Consumption

Since 2021, 38% increase in MB consumed per flight and a 29% increase in flights per day.

Quality of Life Advantages for Businesses

Executives and management teams of an increasing no. of large companies greatly favor BA’s flexibility

Industry Overview - TAM

The majority of existing domestic BA planes are still unconnected, even more so internationally.

Domestic U.S. Market

~220,000 general aviation planes

~ 24,000 of those are BA planes

10,000 turboprops (smallest)

7,000 light jets

3,000 mid-sized jets

4,000 heavy jets

Gogo is making headway toward smaller form factors that work at lower altitude

Recently signed a deal with Cirrus for its very small “Personal Jet” airplane that moves it into even smaller bodies

Only 35% (~8500 planes) of this 24,000 plane fleet is penetrated with IFC; Gogo serves 85% of them

Gogo’s business is split 40/60 between OEM and aftermarket installations

International Market

~14,000 BA planes

Largely untapped market, no pervasive ATG system so only served by larger satellite systems

Gogo Galileo (LEO) could penetrate international market

Gogo’s Stock History

Recent manufacturing troubles of the new 5G chip have sent Gogo’s stock cratering from its ascent. I believe that this presents a special situation to go long on Gogo while uncertainty remains if they can roll out their next generation on time without further delays.

IP1: Gogo is the market leader in US business aviation connectivity with a long penetration runway

Business Aviation is an industry with strong secular tailwinds post-COVID, as it has become essential to companies competing in a marketplace that demands speed, flexibility, efficiency, and productivity for the following reasons:

Safety and Privacy

BA saw a 67% increase in first-time flyers mid-pandemic

COVID surge in demand has lasted post-pandemic (+28% flights from 2019)

Luxury Experience

BA is better suited for productive collaboration and efficiency in-flight

Location Flexibility

BA accesses 10x as many US airports and flies at less congested airfields compared to CA

Timeliness and Reliability

BA is on-demand while 3% of CA flights are cancelled and 25%+ delayed

We also see an increasing number of large companies within the S&P500 using business aviation, either for transporting critical logistics or their C-suite.

Increasing BA demand is being accompanied by more needs for in-flight connectivity - Gogo’s bread-and-butter.

Business aviation’s tailwinds drive the business aviation connectivity industry, as we live in an interconnected world where being plugged in at all times is essential for high functioning enterprise decision making.

There has been a growing market for in-flight connectivity since 2019:

GOGO has seen a 52% increase in total ATG network data consumption from 2019-2021

Data usage/flight hour has increased 77% since 2019 Q3

74% of all BA industry participants would opt to add connectivity to their aircraft today

Positive forward demographic trends for BA penetration

Baby Boomers: 78%

Gen X & Y: 87%

Gen Z: 98%

Positive trends for data usage on existing BA connectivity flights have no foreseeable reason to slow or reverse, especially given 2023’s rise in generative AI potentially fueling productivity growth in the years/decades to come.

Currently, the vast majority of BA flights do not have in-flight connectivity, leaving a high likelihood of increasing market penetration with modern aircrafts.

OEM demand for Gogo’s systems is capped due to aircraft manufacturer constraints but has trended toward 100% annually

78% of the world’s BA flies without connectivity, but this is forecasted to drop to 2% in the next 15 years.

Thus, there is a huge TAM opportunity for Gogo as the industry leader with its solutions.

Key points:

Gogo’s ATG segment trends toward market saturation

Gogo has fitted +400 aircrafts online annually for the past 5 years, expected to increase this pace in coming years as OEM aircraft backlog clears & aftermarket demand holds steady

Targeted 15% long-term growth for its ATG products

U.S. domestic aircraft with competitor GEO solutions are nearly always dual-fitted with Gogo ATG systems, meaning Gogo is still winning & generating revenue here

ATG is optimal price/performance for U.S. domestic travel

GEO covers international waters but has worse performance

Gogo Galileo (LEO) will further expand connectivity TAM

Plans to expand TAM within US and globally through LEO satellite solution partnership AVANCE platform would allow GOGO to enter the relatively-new LEO market at a significantly lower cost than competitors

In short, Gogo’s superior solutions are likely to continue increasing its market share; future offerings will expand TAM.

IP2: Gogo’s near-future technological offerings further improve its unit pricing power

Discontinuing old products & launching its next generation allows Gogo to raise prices for a relatively price inelastic consumer base. Each unit currently costs $50,000 - $250,000 to buy and install, while monthly subscription costs are around $4,000-5,000.

Gogo is on the verge of releasing its next-gen 5G connectivity products which are, in short, faster and better. These products command higher prices in a highly inelastic market

Upon completion of this 5G buildout, GOGO plans to charge 20-50% more per physical unit to be installed in planes, judging from their price advertisements.

Customers will continually migrate toward the new products due to the standard technology upgrade cycle (customers upgrade from older, slower platforms to higher ARPU faster platforms)

Customers demand is extremely sticky and Gogo has faced near zero rates of losing customers to competitors in the past, due to its superior products and service

This migration toward higher margin products will be further catalyzed by Gogo’s planned discontinuation of cheaper legacy ATG Classic platforms in favor of premium AVANCE systems

Gogo will phase out its ATG Classic (limited & slow) platforms by 2026, to push clients to use AVANCE (newer & better).

AVANCE equipment & subscription tiers each cost 20-40% more than Classic, increasing ARPUs

Release of AVANCE L3 in 2024, Gogo’s most affordable platform-based connectivity solution, will allow clients to easily transition from ATG to AVANCE

Gogo is also offering incentives to classic ATG customers to pre-order & upgrade to AVANCE system

Savings of up to $50,000

Led to Q3’23 highest new activations ever of 214, driven by increases 28% increase in upgrades

AVANCE now accounts for 53% of Gogo’s systems in use and will likely trend to 100%

Thus, once the products hit the market I expect Gogo’s top-line to grow significantly in the years after.

IP3: Completion of this 5G upgrade will reduce Gogo’s operating expenses & increase its capital allocation optionality to pursue other high-growth potential projects like Galileo

Gogo’s OpEx and CapEx will likely decline following projected completion in 2024, improving free cash flow.

Operating Margin Expansion is Likely After 5G ATG Buildout is Complete

Engineering, design and development costs decreased slightly when comparing Q3 2023 to Q3 2022 as the 5G buildout nears completion

Management forecasts Gogo’s OpEx to decrease by 3%; CapEx to decrease by 40-50% year over year

SG&A expenses decreased by 3% on a sequential basis

Annual CapEx to decrease by around half to around $25 million

Once the project is complete, capital allocation optionality will allow Gogo to pursue other initiatives that can drive further returns

Chiefly, Gogo plans to continue building out its Galileo (LEO) product in 2024 with another $50m. Further capital allocation toward this would be useful in increasing its odds of become a real option for recurring revenue.

Other options include paydown of leverage

Though Gogo’s current Net Leverage Ratio 2.9x is between LT target of 2.5x-3.5x

Or returning cash to shareholders

Gogo plans to repurchase $50m of common stock opportunistically

Finally, Gogo has plans to continue expanding network into Canada: it won’t be as intensive or extensive as its American network and this will finish by 2024

Valuation - DCF

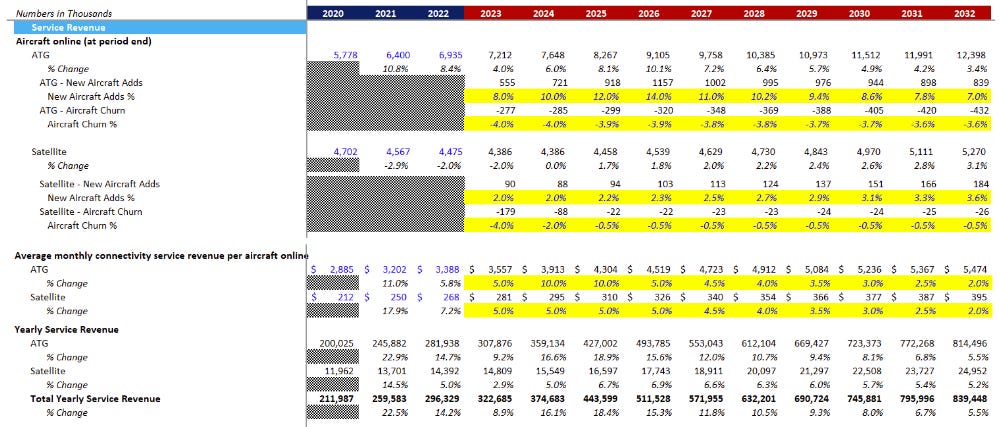

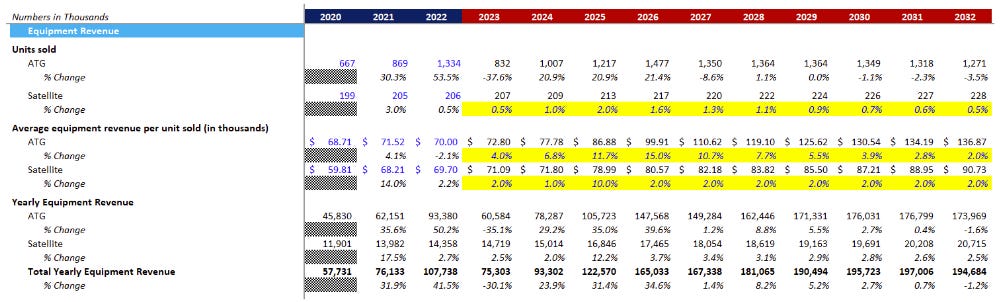

Top-line growth and operating margin expansion are the key drivers for my model of Gogo’s future. I tested 3 scenarios:

Explaining my base case:

For the revenue build, I forecasted churn rates that were more optimistic than the historical numbers I found. This allowed me to forecast aircraft adds to Gogo’s ATG and satellite platforms. I worked my assumptions of pricing power increases across both equipment and service revenues to arrive at average estimates to grow in line with the planned prices of Gogo’s future offerings, extrapolating the effect of inflation thereafter.

For operating expenses, I predicted that post-5G release, Gogo’s sales & marketing + R&D expenses would decline through 2025/26 before picking up again for a theoretical future project to enhance their products.

Weighting the bear case 20%, base 50% and bull 30%, I arrived at target upside of 60.7%, with a 12 month price target assuming Gogo can get its solutions out by end 2024.

I chose not to do a relative valuation / comps table because only Viasat is publicly traded, and that business is fundamentally different to Gogo’s (sells to entirely different industry of customers etc.).

Risks

While Gogo does face several operational risks, I believe that odds are stacked in favor of upside.

Risk 1: Gogo’s 5G upgrade rollout is slower than expected, impacting FCF projections

Concerns about future delays with Gogo’s 5G chip have manifested as a 40% stock price decline. However, information out there indicates:

The current 6-month delay is a minor setback

Current issue with 5G chip is from a manufacturing error, and not related to the 5G components, which have been subject to extensive testing.

5G infrastructure is already set for 5G availability, with 150 cell towers all across the USA/

Customer expectations remain highly optimistic

Zero customer cancellations due to delay, pre-orders are in.

Gogo has received orders from 5 aircraft OEMs and have built an $8.5 million backlog for chip sets

Recent stock price action illustrates a difference in opinions

40% decline since the delay announcement by Q2 despite unchanged fundamentals

Suggests market participants are pricing in Gogo’s risk of missing revenue guidance

This is an opportunity to bet on the bullish side of the trade; potential to capture large upside with a higher margin of safety.

Additionally, Gogo is confident its chip manufacturer has identified the issue and no future delays will occur

GCT, Gogo’s chipset supplier has introduced a new undisclosed design house to the project

GCT is the 3rd largest supplier of chips in this sector behind Qualcomm and MediaTek

New technologies are being employed to stress test for further potential problems.

Utilizing new higher-speed 50 megahertz field programmable gate array technology (FPGAs) to test many aspects of the chip before the chip itself arrives.

Gogo expects to have the FPGA technology in place from their vendors in late Q1 and expects to begin flight testing with it in Q2, which is expected to burn down all software testing risk, 5G design testing risk and system integration risk

Risk 2: External Factors in the Aircraft Industry Can Affect Gogo’s Business

Demand for Gogo’s services is indirectly affected by fluctuations in BA manufacturing & maintenance cycles.

Chiefly, Gogo’s business model is susceptible to pauses & suspensions

Suspensions are when customers pause subscription of Gogo’s services due to maintenance, owner changes, etc.

Q2’23 was Gogo’s highest suspension quarter ever, up 31% YoY

Driven by a 33% increase in maintenance suspensions and a 41% increase in management changes.

Suspensions lasting longer: 66% of suspensions >30 days vs 55% in 2022.

Nevertheless, the current spike in suspensions is a minor, temporary & usual headwind.

Current wave due to increased aircraft flying following COVID resulting in a maintenance backlog

93% of suspensions historically returned within 7 months

0% of suspensions led to business being lost to a competitor

Furthermore, the manufacturing schedule of aircraft OEMs provide predictable adoption trends for Gogo’s products.

The US (Gogo’s main market) receives the majority of BA jets built. OEMs historically build 600-800 planes a year for BA buyers worldwide; ~50% are delivered to within the US.

Currently, a lack of engine parts is slowing down overall OEM production, but strong demand from customers for OEM BA planes should be sustained.

As mentioned many times before, Gogo is the sole reliable player in this space

Competing ATG, GEO and LEO solutions fail to reach Gogo’s price/performance ratio

Increased OEM production means increased purchases of in-flight connectivity; most new BA buyers will want in-flight connectivity, given the demographic change in the market

Risk 3: SmartSky ATG Challenges Gogo’s Incumbent Position

Potential competition from SmartSky networks, should their product be viable, may reduce Gogo’s market share.

However, Gogo is ahead of them in performance and adoption

SmartSky has < 2% market share

Product is marginally better than Gogo’s existing products, but is left in the dust by Gogo’s 5G Avance.

Additionally, their lack of reputation leading to weak pricing power illustrates SmartSky’s losing position.

Smartsky’s aggressive promotion may encourage customers to switch systems, but such heavy incentives are indicative of their weakness.

50,000$ cash back following the activation of their system, for a trade in of GOGO systems

35,000$ cash back without trade in

25,000$ and 10,000$ for the same deals with their cheaper system, SmartSky Lite

These promotions are only available for a limited time, as they are not sustainable

Low probability of incumbent & new customers favoring SmartSky.

Smartsky was founded over 10 years ago but has only just gotten around to producing a product which is about to match one Gogo is phasing out

Zero pre-existing relationships with OEMs, and no brand name

Negative reputation of missing deadlines and burning through cash

SmartSky seeks every opportunity to drag down Gogo in the press.

SmartSky filed an IP infringement toward Gogo in Feb. 2022

Gogo Chairman claimed “Gogo is not infringing any valid SmartSky patent”

Two more patents were added to the case this February.

Final Recommendation

Gogo is a market leader poised for continued growth beyond 2024 after its next-gen technology rollout. Its business has incredible margins, an inelastic customer base, and operates in a market yet to be saturated. Furthermore, it has a clear and probable plan to increase top-line + bottom-line growth once their new products release - if they do release successfully on time. The recent drop in its stock price presents an interesting buying opportunity; I believe it is worth a long position in given the elevated margin of safety after the last few months.